Empowering Women Through VSLAs: Strengthening Financial and Non-Financial Services in Kassala and Gedaref

Creation of new women’s Village Savings and Loans Associations (VSLAs) and provision of financial and non-financial services to association members in Kassala and Gedaref States

Kassala and Gedaref, June 2025

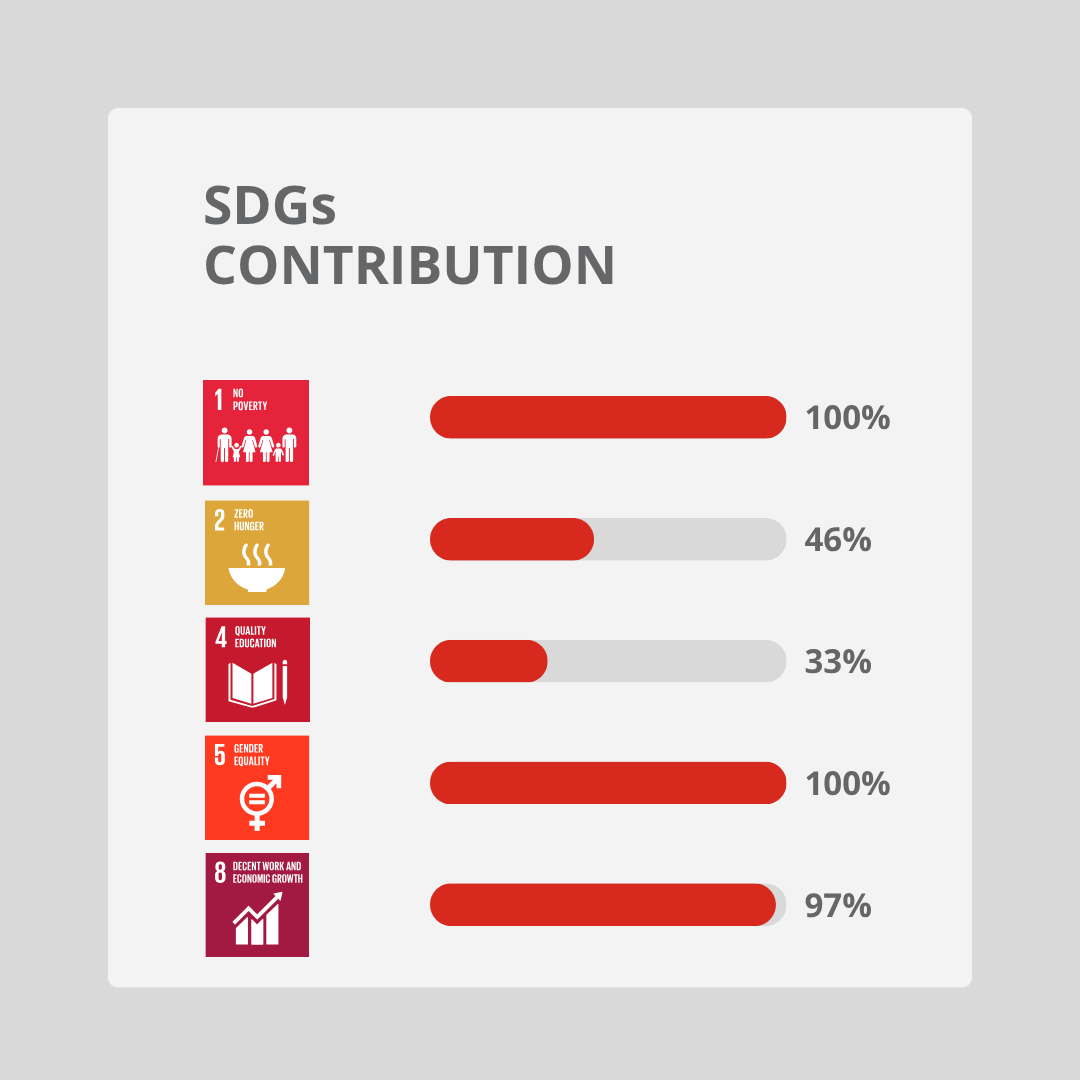

As part of the WE-RISE! project, a transformative initiative has taken root in Sudan’s Kassala and Gedaref States: the creation and strengthening of Village Savings and Loans Associations (VSLAs) for women, alongside the delivery of tailored financial and non-financial services. This effort is a strategic response to enhance women’s economic empowerment and promote financial inclusion in conflict-affected and underserved areas.

Funded by the European Union and implemented by the Italian Agency for Development Cooperation (AICS) Addis Ababa and UN Women, this initiative has been a cornerstone of the broader WE-RISE! project. Between February 2023 and September 2024, the VSLA component successfully fostered local capacity, expanded access to informal finance, and bolstered women’s entrepreneurial potential.

VSLAs

Direct beneficiaries

Budget

The project is designed to:

- Establish 151 new VSLAs and scale up 50 existing ones.

- Provide financial education and literacy training to ensure informed financial decision-making.

- Improve women’s access to capital through structured savings and credit mechanisms.

Implementation approach

The initiative is led by Child Development Foundation (CDF), a Sudanese NGO with extensive expertise in VSLA facilitation and financial inclusion. The implementation strategy follows a structured four-phase approach:

- Community Mobilization & Awareness: Facilitating engagement with local stakeholders to enhance project buy-in, addressing socio-cultural barriers, and promoting women’s financial participation.

- VSLA Formation & Strengthening: Establishing 91 new VSLAs in Kassala and 60 in Gedaref, while enhancing 50 pre-existing groups.

- Capacity Building: Providing targeted financial literacy, business development, and vocational training programs.

- Institutional Linkages & Financial Access: Registering VSLAs as legally recognized entities to enable engagement with microfinance institutions and formal credit providers.

With a strong focus on women empowerment, the project actively tackles sociocultural barriers and mitigates gender-related tensions. The team engages male stakeholders to clarify the rationale for prioritizing women, emphasizing the far-reaching economic and social benefits.

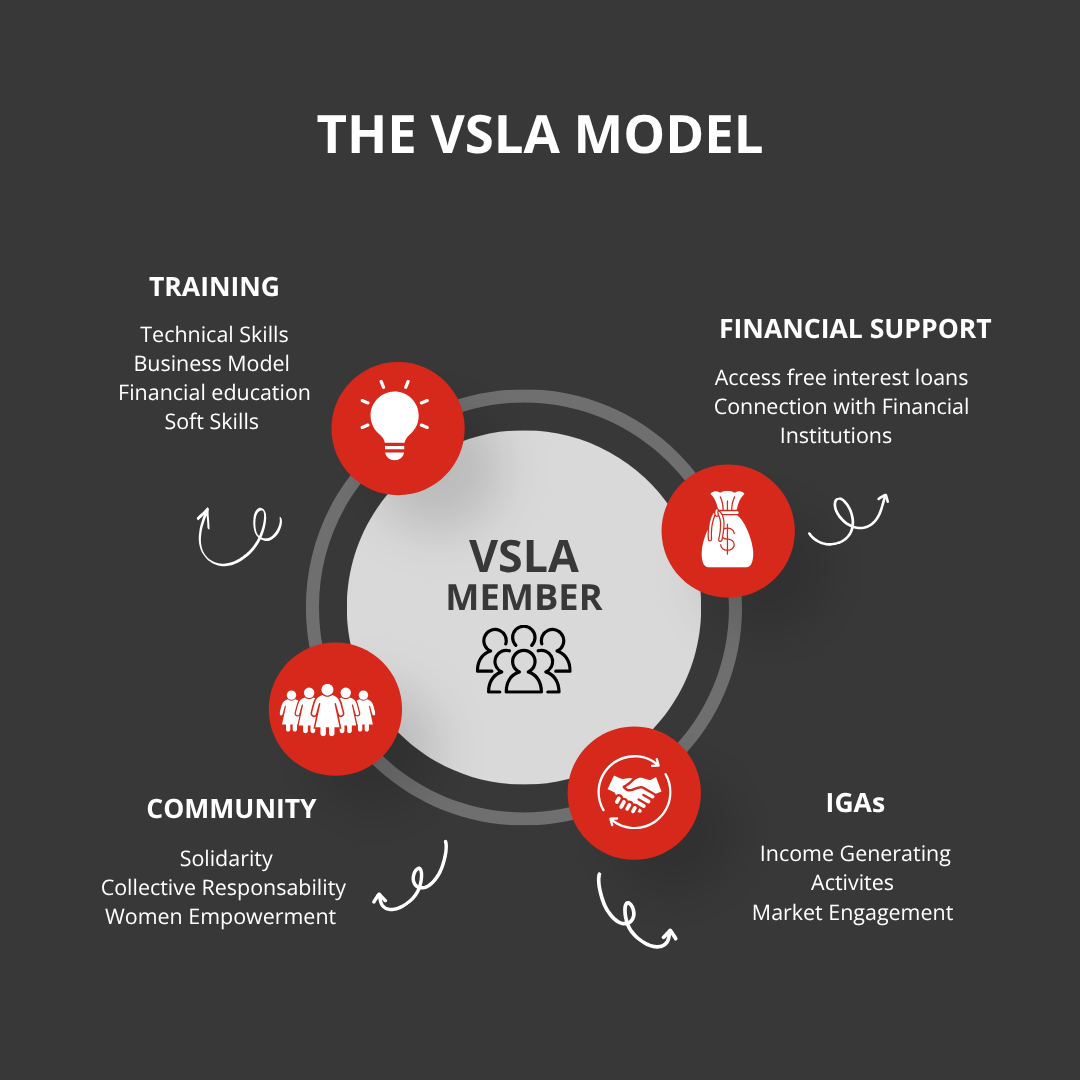

What is a VSLA?

A Village Savings and Loans Association (VSLA) is a self-managed, community-based financial group—typically composed of 25–30 members—who collectively save money and provide interest-free loans to one another. This model is especially valuable in rural and underserved areas with limited access to banks or credit.

In Kassala and Gedaref, the VSLA approach was adapted to align with Islamic financial principles through the Sunduq model. These community funds operate under Sharia-compliant structures such as the Takaful system, avoiding interest (riba) and promoting ethical, equitable finance through shared risk and mutual support.

The project established 151 new Village Savings and Loan Associations and upscaled 50 existing ones in Kassala and Gedaref States.

Capacity building

The core phase of the CDF assignment focused on designing and delivering a comprehensive training program for all target VSLAs across 11 villages. CDF trainers delivered 97 training sessions from November 2023 to May 2024, covering 5 core thematic areas:

- Life skills

- Vocational training

- VSLA creation and management

- Reflect-literacy (adult education)

- Microcredit and entrepreneurship

A total of 5,357 beneficiaries participated in the trainings. To reinforce learning and encourage practical application, participants were provided with customized training toolkits that supported both group management and individual income-generating activities. All newly formed VSLAs were officially registered, making them eligible to access services from banks and microfinance institutions, and helping members grow their businesses and stabilize household incomes.

Challenges, Adaptation, and Resilience

Despite difficult operating conditions—including conflict, displacement, and communication disruptions—the project maintained momentum through adaptability and strong local partnerships. Key challenges and responses included:

- Security risks and restricted access: Local leaders were mobilized to continue activities in hard-to-reach areas.

- Agricultural calendar conflicts: Training schedules were adapted to accommodate farming responsibilities.

- Cultural norms: Community meetings and male engagement helped shift perceptions and encourage women’s participation.

Results and Lessons Learned

Over 5,000 women across Kassala and Gedaref directly benefited from the initiative. Beyond the numbers, the project left lasting impacts by improving financial independence, enhancing business skills, and fostering community cohesion.

Key lessons include:

- Community-based models work: Local ownership and culturally sensitive facilitation were central to success.

- Informal finance is powerful: VSLAs provided women with an alternative to high-interest loans.

- Linking informal and formal finance matters: Legal recognition and access to MFIs expanded financial inclusion.

- Local capacity is essential: Trained facilitators played a critical role, especially amid external disruptions.

A Path Forward

This initiative proved that even in fragile contexts, economic empowerment and resilience can be fostered through inclusive, locally-driven financial models. The VSLA approach—combined with strategic capacity building and institutional partnerships—has helped lay a strong foundation for women’s long-term economic participation and community development in Sudan.

The VSLA project in Sudan highlighted the transformative power of community-based approaches in advancing women’s economic empowerment and financial inclusion. Despite operating in a conflict-affected environment, the project demonstrated strong resilience and adaptability, enabling over 5,000 women to improve their financial stability, launch small businesses, and access zero-interest loans. Strategic partnerships with government bodies and financial institutions ensured local relevance and sustainability, while investment in local capacity building proved essential. Ultimately, the project showcased how inclusive financial models can strengthen the economic resilience of vulnerable communities, especially when tailored to local realities and supported by strong institutional linkages.

About the service provider

CDF – Child Development Foundation is a Sudanese national NGO established in 1999 and registered under the Humanitarian Aid Commission (HAC). Born as an NGO mainly focused on the protection of children’s rights, in the last decade CDF gained extensive experience in the start-up, monitoring and technical support of Village Savings and Loans associations. Thanks to its track record, in 2007 CDF was awarded by the United Nations Economic and Social Council (ECOSOC) with an advisory status.